The UK has a proud history of producing some of the best quality defence equipment in the world, from fighter aircraft to missiles and machine guns. As one of the most dynamic manufacturing industries, which, together with aerospace, accounts for over £12 billion in output, the defence sector is well-positioned to support the UK economy as it rebounds from the slump caused by the global pandemic.

Read More

Topics:

Precision Engineering,

UK Manufacturing

Industrial rollers are key components in many types of machinery, particularly in the printing and packaging industry. They are predominantly used to move a variety of product through complex processing equipment but also provide essential support when material is moved through a machine, preventing it from becoming out of place, dislodged, or jammed.

Read More

Topics:

Precision Rollers,

Industral Rollers,

Rollers

At Hone-All, we have the knowledge, skills, and expertise to tackle complex projects in a range of sectors. As a family-run business that prides itself on teamwork, collaboration, and communication, we’re not constrained by muted ambition; instead, we invest in our teams and technology to ensure the highest quality service for our customers in diverse areas of industry, from aerospace and pharmaceuticals to defence and motorsport.

Read More

Topics:

Precision Rollers,

Deep Hole Boring,

Aerospace Industry,

Industrial Rollers,

CNC Turning,

Precision Machining,

Precision Engineering,

UK Manufacturing,

Engineering,

Hydraulic Systems

In the 2020-2021 season, the global audience watching Formula 1 reached 433 million viewers, making it one of the world’s most popular sports. Yet few people realise that each F1 car is constructed from an astounding 80,000 separate components, making each vehicle a compressed 720kg package of hydraulic systems, mechanical devices, carbon, tyres, and fuel!

Read More

Topics:

Precision Machining,

Precision Engineering,

UK Manufacturing,

Engineering,

Hydraulic Systems

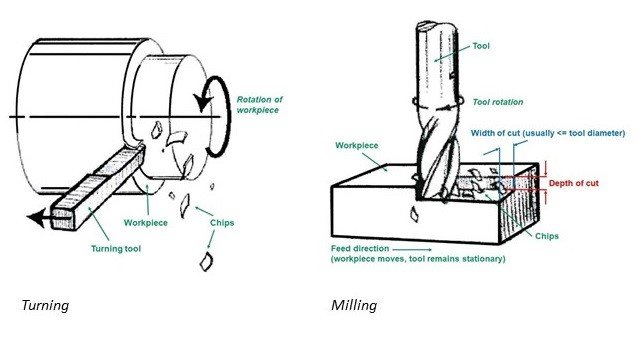

Computer Numerical Control (CNC) technology is at the forefront of the precision machining industry, yielding greater control, more accurate results, and a reduced need for manual intervention during the manufacturing process.

Read More

Topics:

CNC Turning,

Precision Engineering,

CNC Machining Quotes,

CNC Machining,

UK Manufacturing

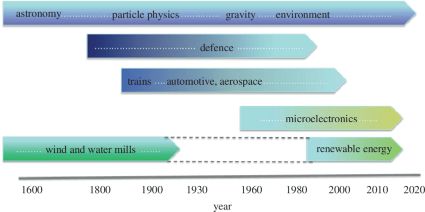

Precision engineering methods have been at the heart of manufacturing for nearly 200 years, since the first mills were designed to offer a faster, more cost-effective way to create new products. This ‘Sustainable Revolution’ is witnessing a shift towards cleaner, renewable energy sources across the manufacturing sector, such as solar, wind, hydroelectric, and geothermal power.

Read More

Topics:

Precision Machining,

Precision Engineering,

Precision drilling

We are looking forward to welcoming a new Pinacho ST285 CNC lathe to our workshop here at Hone-All, after accepting a quote from C Dugard Ltd, of East Sussex.

This is an exciting investment for us because it is the first CNC lathe we’ve purchased with a C-axis. The additional axis gives us the capacity to drill and tap on PCDs and machine keyways/slots in-house, increasing the range of services we can offer. Previously we had to either subcontract this aspect of our work to a trusted supplier (with customer permission of course), or request the customer to arrange it themselves after machining – something we were always uncomfortable with because it meant we couldn’t offer an end-to-end service.

Read More

Topics:

CNC Honing,

CNC Turning,

Precision Engineering,

CNC Lathe,

CNC Machining Quotes,

CNC Machining

A wide range of materials are used in CNC machining, making it one of the most versatile methods in modern precision manufacturing. Most metals are compatible with CNC machining, alongside several plastics and polymers, and even certain foams. Your choice of material hinges on the purpose of the component, the environment in which it will be used, it’s stress load, and your production budget.

Read More

Topics:

CNC Honing,

CNC Turning,

Precision Machining,

Precision Engineering,

CNC Machining

Precision engineering is now one of the most widely used techniques in manufacturing, responsible for manufacturing the majority of everyday items, alongside specialist and precision components used in engines, pumps, and machinery.

Read More

Topics:

CNC Turning,

Precision Machining,

Precision Engineering,

UK Manufacturing

Few people foresaw the Covid-19 pandemic and, in a world in which global supply chains had become the norm for many businesses, disruption was unsurprisingly high. With many countries implementing lockdowns at different times, manufacturing hubs subjected to short-notice closure, and international shipping routes restricted, supply chains have suffered. Furthermore, unstable political climates have forced many businesses to evaluate their dependence on international suppliers and markets.

Read More

Topics:

CNC Honing,

Aerospace Industry,

Tube Manufacturing,

UK Manufacturing,

Supply Chain UK